Protecting Domestic Energy Supply

Protecting Domestic Energy Supply

Residential rooftop solar is critically important for the U.S., ensuring resiliency, security, and energy independence while helping us meet the challenge of increasing power demand.

Solar Investment Tax Credit (ITC)

The ITC has been instrumental in driving the adoption of residential solar energy in the U.S. — and it’s necessary to protect key ITC elements to support its continued advancement.

Section 48(E)

This provision of the tax code provides an ITC to corporations that own and develop solar and storage generation projects (as well as other generation such as nuclear and hydro power). The ITC provides immediate financing to support the rapid deployment of generation resources — necessary to help us meet rising demand — and offers market certainty for companies to develop long-term investments that drive competition and technological innovation which, in turn, lowers energy costs for consumers.

Section 48(E)

This provision of the tax code provides an ITC to corporations that own and develop solar and storage generation projects (as well as other generation such as nuclear and hydro power). The ITC provides immediate financing to support the rapid deployment of generation resources — necessary to help us meet rising demand — and offers market certainty for companies to develop long-term investments that drive competition and technological innovation which, in turn, lowers energy costs for consumers.

Tax Credit Transferability

Tax credit transferability is an important mechanism for solar financers, enabling the efficient utilization of tax credits by expanding the population of eligible investors. In turn, transferability lowers the costs of capital for energy projects.

Tax Credit Transferability

Tax credit transferability is an important mechanism for solar financers, enabling the efficient utilization of tax credits by expanding the population of eligible investors. In turn, transferability lowers the costs of capital for energy projects.

ITC History

ITC History

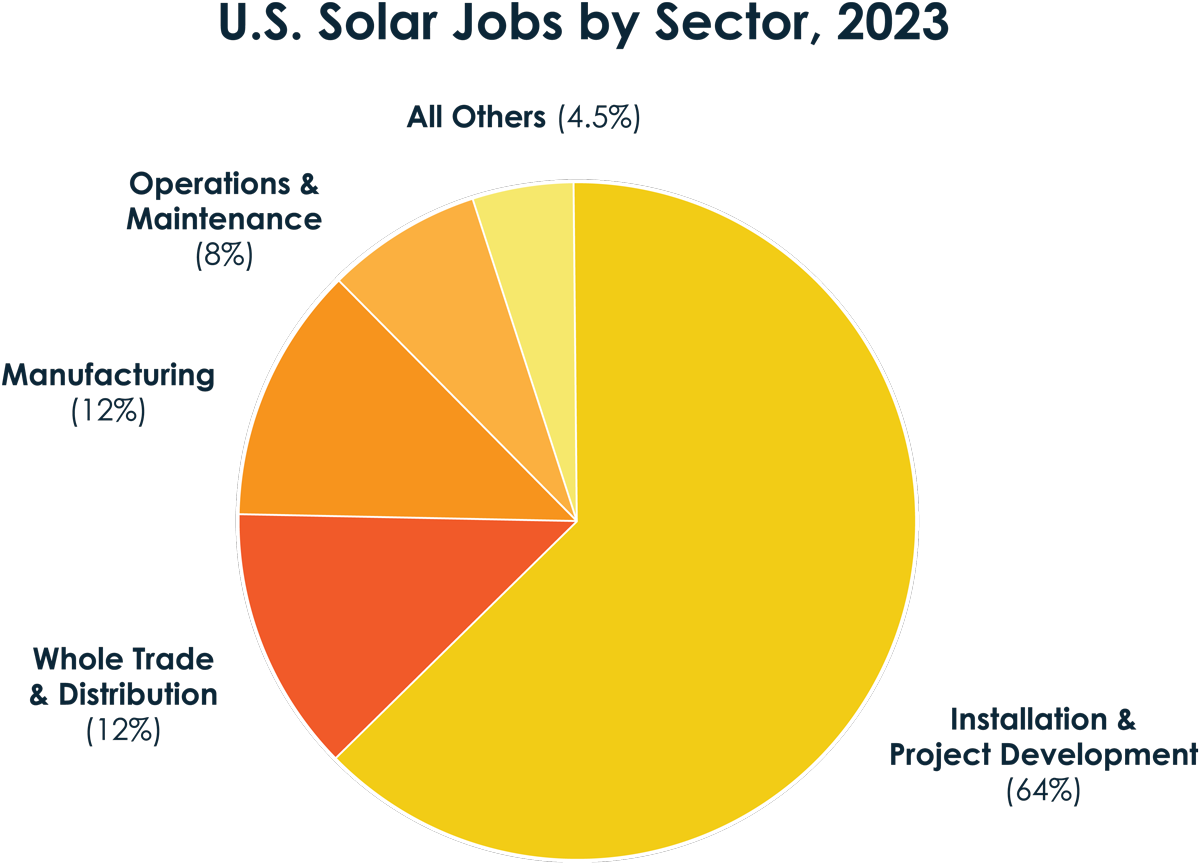

Protecting energy jobs

According to a report from the Interstate Renewable Energy Council (IREC), nearly 50% of solar jobs in the U.S. are in the residential solar sector. These are family-supporting careers located in communities across the U.S. — jobs that cannot be exported. Additionally, of all solar careers in the U.S., more than 60% are in rooftop installation, sales, and project development.